State of California Investor Relations

State of California Investor Relations

View additional resources from State of California Investor Relations, including our MSRB EMMA® Links, Frequently Asked Questions, Contact Information, Links to State Agencies and Additional Resources, Additional Contact Information, Bearer & Registered Bonds, and State Holidays

Add this issuer to your watchlist to get alerts about important updates.

View additional resources from State of California Investor Relations, including our MSRB EMMA® Links, Frequently Asked Questions, Contact Information, Links to State Agencies and Additional Resources, Additional Contact Information, Bearer & Registered Bonds, and State Holidays

View a list of our CUSIPs and see links to more information about our municipal bonds on the MSRB EMMA® website.

View MSRB EMMA® LinksLooking for more information about us and our bond programs? Get answers to common questions by following the link below.

View FAQStill have questions? You can reach us by mail, phone, or email.

P.O. Box 942809

Sacramento, CA 94209-0001

Phone: (800) 900-3873

State Agencies

Department of Finance: The Department of Finance (DOF) establishes fiscal policies to carry out the State's programs; prepares, explains, and administers the State's annual budget; analyzes legislation that impacts the State fiscally; trains and supports departmental accounting; monitors and audits expenditures by State departments to ensure compliance with the law, standards, and policies; develops economic forecasts and revenue estimates; develops population and enrollment estimates and projections; conducts fiscal analyses of proposed statewide information technology policies and enterprise initiatives; and performs oversight of critical IT projects.

State Controller's Office: The State Controller's Office (SCO) is responsible for the accountability and disbursement of the State's financial resources; safeguarding of various property until claimed by the rightful owners (Unclaimed Property); independently audits government agencies that spend State funds; administers the payroll system for State and California State University employees.

State Treasurer’s Office: The State Treasurer, a constitutionally established office, provides banking services for State government with goals to minimize interest and service costs and to maximize yield on investments. The Treasurer is responsible for the custody of all monies and securities belonging to or held in trust by the State; investment of temporarily idle state monies; administration of the sale of state bonds, their redemption and interest payments; and payment of warrants or checks drawn by the State Controller and other state agencies.

Legislative Analyst's Office: The Legislative Analyst's Office (LAO) provides fiscal and policy advice to the State's Legislature.

California Legislative Information: Commonly referred to as Leginfo, this website provides information on the State’s assembly and senate bills, California codes, and the California Constitution.

California Public Employees' Retirement System: The California Public Employee Retirement System (CalPERS) manages retirement benefits for member California State and local public servants.

California State Teacher's Retirement System: The California State Teacher's Retirement System (CalSTRS) provides retirement benefits to California's public school educators from prekindergarten through community college.

California Employment Development Department: The California Employment Development Department (EDD) administers unemployment and disability insurance, payroll tax collection, and job training/workforce services.

Board of Equalization: The Board of Equalization (BOE) administers the review, equalizing, or adjusting of property tax assessments; assesses taxes on insurers; and assesses/collects excise taxes on alcoholic beverages.

California Department of Tax and Fee Administration: The California Department of Tax and Fee Administration (CDTFA) administers sales and use taxes in addition to various tax and fee programs.

Franchise Tax Board: The Franchise Tax Board (FTB) provides collection and administration of the State's personal income tax.

Educational Resources

Municipal Market Regulators

Bond/Coupon Payments (Bearer Bonds and Registered Bonds)

State of California* bearer bonds and registered bonds can be presented for payment through either the State Treasurer’s Office or The Bank of New York Mellon Trust Company, N.A. (BNY). BNY acts as the fiscal agent for certain State of California general obligation bonds and revenue bonds. See the instructions below for how to present bearer and registered bonds and/or interest coupons.

State of California Bearer Bonds and Registered Bonds

Before 1991, most State of California bonds were issued as bearer bonds or registered bonds. The final due date (maturity date) for these bearer and registered bonds was July 1, 2022.

Bonds and coupons are payable on or after their respective due dates. However, sometimes bonds are called for early redemption – this means they become due prior to their stated maturity date (i.e., payment is due on the related redemption date). After a bond is called for redemption, it no longer accrues interest from and after its redemption date.

A bond can be presented for payment after the redemption date; however, any coupons for that bond dated after the redemption date are no longer valid. To check whether a bond has been called for redemption, contact the State Treasurer’s Office via phone at 1 (800) 900-3873 or email to CalBONDS@treasurer.ca.gov.

Bonds/Coupons with Payment Date before January 1, 2007:

These bonds and coupons are serviced directly by the State Treasurer’s Office.

For information on how to request payment for a bond and/or coupon, contact the State Treasurer’s Office via phone at 1 (800) 900-3873 or email to CalBONDS@treasurer.ca.gov.

When presenting bonds and/or coupons for payment to the State Treasurer’s Office, bondholders must include the following:

Bondholders may request payments for bonds and/or coupons by mail or by scheduling an appointment with the State Treasurer’s Office. If submitted by mail it is suggested bondholders acquire mailing insurance. The State Treasurer’s Office is not responsible for bonds and/or coupons lost in the mail.

Send all required documents to:

California State Treasurer’s Office

Public Finance Division

Bondholder Redemption Payment Request

P.O. Box 942809

Sacramento, CA 94209-0001

In-Person Appointments

As an alternative to mailing, a bondholder may present bonds and/or coupons in person. Bondholders should call or email the State Treasurer’s Office to schedule an appointment. At the scheduled appointment, bondholders should bring the original bonds and/or coupons. An IRS Form W-9 will be provided to complete during the appointment.

Bonds/Coupons with Payment Date on or after January 1, 2007:

These bonds and coupons are serviced directly by BNY.

For information on how to request payment for a bond and/or coupon, contact BNY’s Bondholder Relations Department via phone at 1 (800) 254-2826 or email to corporate.bond.research@bankofny.com.

When presenting bonds and/or coupons for payment to BNY, bondholders must include the following:

BNY only accepts bonds and/or coupons by mail. It is suggested bondholders acquire mailing insurance. BNY and the State Treasurer’s Office are not responsible for bonds and/or coupons lost in the mail.

Send all required documents to:

BNY Corporate Trust

Transfers/Redemptions

500 Ross Street, Suite 625

Pittsburgh, PA 15262

* Important Note on Non-State of California Bonds:

Cities, counties, and other municipal issuers in California also issued bearer and registered bonds in the past. These bonds may indicate they are from an entity located in “The State of California,” but that does not mean they are payable from funds of the State of California or by the State Treasurer’s Office.

To determine whether you have a bond payable from funds of the State of California, please email a copy of your bond to CalBONDS@treasurer.ca.gov. Be sure to include your name, mailing address, phone number, and email address.

Please allow at least 1-3 business days for a response.

** What to Include in the signed Letter of Instruction:

*** Original Documents Only:

Only original bonds and coupons will be accepted for presentation. If a bond is lost or stolen, contact:

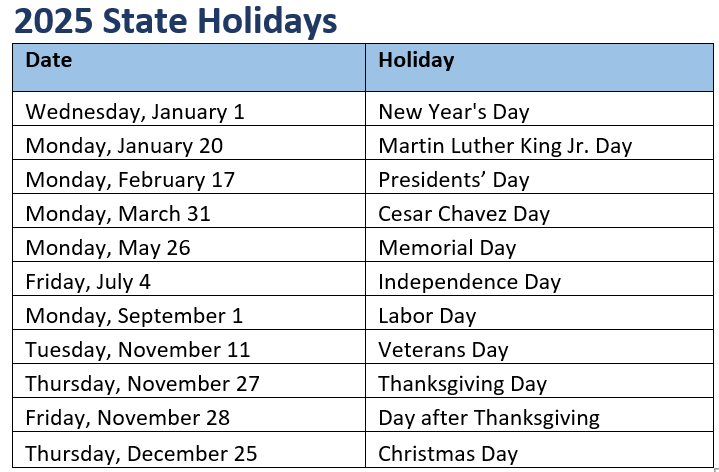

The California State Treasurer’s Office will be closed on certain State holidays.

Currently State holidays observed by the State Treasurer’s Office are January 1 (New Year’s Day); the third Monday in January (Martin Luther King Jr.’s Birthday); the third Monday in February (President’s Birthday); March 31 (Cesar Chavez’ Birthday); the last Monday in May (Memorial Day); July 4 (Independence Day); the first Monday in September (Labor Day); November 11 (Veteran’s Day); Thanksgiving Day and the day after Thanksgiving; and December 25 (Christmas Day ). If January 1, March 31, July 4, November 11, or December 25 falls on a Sunday, the following Monday shall be deemed the holiday in lieu of the day observed. If November 11 falls on a Saturday, the preceding Friday shall be deemed to be the holiday in lieu of the day observed. Certain State holidays may fall on days that are not banking holidays, and as noted, can vary from year to year. The list of State holidays observed by the State Treasurer’s Office may, from time to time, be changed in accordance with the laws of the State.

Documents under which the State Treasurer acts as trustee or paying agent exclude the State holidays observed by the State Treasurer from the definition of “Business Day.” Generally, if any payment is due on a day other than a business day, such payment will be made on the next succeeding business day, and no interest will accrue as a result.

“Business day” is typically defined in the respective authorizing documents to mean any day other than a Saturday, a Sunday, a State holiday and any other day specifically designated in such document to not be a business day, e.g. any day when the principal office of a trustee or paying agent is authorized to be closed or on which the New York Stock Exchange is closed.

Please contact Investor Relations for more information at 1(800)900-3873 or InvestorRelations@treasurer.ca.gov.

The State holidays for 2025 are listed below.